Tune in. Drive the conversation

Not your information? Reset form

If you have not received this invitation directly from Fidelity, please contact us for information on how you can attend.

Fidelity Insights Class

A core equity holding that seeks to identify companies that the portfolio manager believes will offer sustained, above-average earnings growth.

Visit the fund page →A very happy birthday.

Series F

PERFORMANCE AS AT APRIL 30, 2018

JAN 26, 2017

Stratégies à date cible de Fidelity : leur fonctionnement

Que votre retraite soit toute proche ou encore loin, nous pouvons vous aider à atteindre vos objectifs de retraite. Apprenez-en davantage sur le fonctionnement des stratégies à date cible.

Will brings the right insight to your portfolio

As portfolio manager of (U.S.) Fidelity Contrafund, one of the world's largest actively managed mutual funds, Will Danoff gets access to top executives at thousands of companies.

Read the Wall Street Journal article →Will brings the right insight to your portfolio

As portfolio manager of (U.S.) Fidelity Contrafund, one of the world's largest actively managed mutual funds, Will Danoff gets access to top executives at thousands of companies.

Read the Wall Street Journal article →Speak to an advisor about how Will’s funds can help your portfolio grow.

Register or log in to fidelity.ca to learn more about Will and his investment approach.

Log in →Why Will Danoff?

Will Danoff joined Fidelity in 1986 as an equity analyst and later served as a portfolio assistant on Fidelity Magellan Fund, managed by renowned investor Peter Lynch. In 1990, he took the helm of Fidelity Contrafund, beginning a legendary run that has lasted more than a quarter-century.*

As manager of one of the world’s largest actively managed mutual funds, Will personally meets with hundreds of companies each year.

With nearly 35,000 meetings logged in his career, Will has forged a deep understanding of what it takes to deliver strong growth over the long term.

The Fidelity way.

In an ever-changing and complex financial services world, we’re committed to developing quality products that provide long-term value.

Fidelity is one of the world’s largest providers of financial services. As a privately owned firm, we have been providing investment solutions and innovations to our clients for more than 70 years. We’ve invested in unparalleled research, bottom-up fundamental analysis, product innovation and our people. With over 800 investment professionals worldwide, Fidelity takes local market knowledge, identifies real opportunities and makes them available to you here at home.

Learn more about Fidelity →

Will Danoff joined Fidelity

as an equity analyst and later

served as a portfolio assistant on

Fidelity Magellan Fund, managed

by renowned investor Peter Lynch.

In 1990, he took the helm

Contrafund, beginning a legendary

run that has lasted more than a

quarter-century.*

As manager of one of the world’s

largest actively managed mutual funds,

Will personally meets with hundreds of

companies each year.

With nearly 35,000 meetings

in his career, Will has forged a deep

understanding of what it takes to deliver

strong growth over the long term.

Fidelity Global Growth and Value Class

A combined growth and value approach that provides diversification across sectors, market capitalizations and regions, and offers the potential for strong risk-adjusted returns.

Visit the fund page →

Has latine phaedrum ne, constituto elaboraret at vim. Eu cum atu intellegat, te sit vide evertitur. In usu quas possim en similique, assentior democritum. Ullum scripta ne pri, in mund.

Jeff Moore

Portfolio manager title

In usu quas possim similique

Has latine phaedrum ne, constituto elaboraret at vim. Eu cum consul atu intgat, te sit vide evertitur. In usu quas possim similique, te vix assentior democritum. scripta ne pri, in eos mund.

Constituto elaboraret at vim. Eu cum consul atu intellegat, te sit vide evertitur. quas possim similique, te vix assentior democritum. Ullum scripta ne.

More information →

John Smitherson

Vice-President, Advisor National Sales

Has latin e phaedrum ne, constituto elaboraret at vim. Eu cum consul atu intellegat, te sit vide evertitur. In usu quas possim similique, te vix assentior democritum. Ullum scripta ne pri, in eos mund.

[email protected]

(123) 456-7890

”Has latine phaedrum, constituto elaboraret at vim. Eu cum intellegat, In usu quas possim, assenti democrit umullum scripta.”

Darren Lekkerkerker

Portfolio manager, Fidelity Canadian Asset

Allocation Fund

”Has latine phaedrum, constituto elaboraret at vim. Eu cum intellegat, In usu quas possim, assenti democrit umullum scripta.”

Darren Lekkerkerker

Portfolio manager, Fidelity Canadian Asset

Allocation Fund

”Has latine phaedrum, constituto elaboraret at vim. Eu cum intellegat, In usu quas possim, assenti democrit umullum scripta.”

Darren Lekkerkerker

Portfolio manager, Fidelity Canadian Asset

Allocation Fund

Face to Face with Fidelity 2018

Face to Face with Fidelity 2018 offers you a unique opportunity to visit Fidelity’s worldwide headquarters in Boston and perform your own due diligence on Fidelity’s investment process and portfolio managers. Here’s what we have in store:

- Meet directly with Fidelity portfolio managers

- Get a first-hand look inside Fidelity’s world-class research facilities

- Learn how Fidelity can support your business now and in the future

Fidelity’s event app will provide online access to all of the materials. Once registered, you will receive an information email about the event that will include details about the app.

Earn CE credits

In addition, you can also earn valuable continuing education credits. CE credits will be assigned retroactively. Fidelity will apply to the following governing bodies for CE approval after the event:

- The Institute (IAFE)

- Investment Industry Regulatory Organization of Canada (IIROC)

- Chambre de la sécurité financière (CSF)

- Institut québécois de planification financière (IQPF)

- Alberta Insurance Council (AIC)

- Insurance Council of Manitoba (ICM)

- Insurance Councils of Saskatchewan (ICS)

- Financial Planning Standards Council (FPSC)

| Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|

| Welcome reception: Business casual |

Advisor seminars at hotel: Business casual |

Advisor seminars at hotel: Business casual |

Breakfast: Casual |

| Spousal/guest tour: Casual |

Spousal/guest tour: Casual |

||

| Dinner: Business casual |

Dinner: Casual |

No, National Instrument 81-105, Mutual Fund Sales Practices, does not permit Fidelity Investments to pay for or provide transportation for attendees to and from an event. (This includes the payment of a car rental fee, parking expenses any gas or mileage in relation to a car used by an attendee during the conference.) If applicable, you will need to make and pay for your own arrangements for airport transfer via your preference (taxi, car rental, airport shuttle, etc.)

No, National Instrument 81-105, Mutual Fund Sales Practices, does not permit Fidelity Investments to pay for or provide transportation for attendees to and from an event. (This includes the payment of a car rental fee, parking expenses any gas or mileage in relation to a car used by an attendee during the conference.) If applicable, you will need to make and pay for your own arrangements for airport transfer via your preference (taxi, car rental, airport shuttle, etc.)

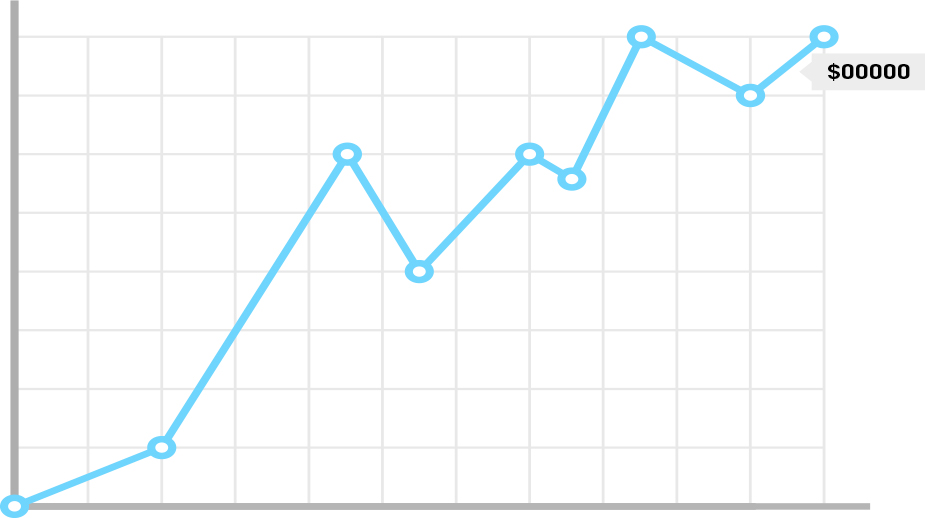

Make the most of your money

Fidelity Small Cap America Fund

This award-winning fund has continued to concentrate on a stable of high quality businesses that have the potential to outperform over time.

Designed specifically for the investor with a long-term view, you’ll gain exposure to small U.S. companies while, at the same time, aiming to lessen the overall effects of market volatility.

As you can see, the results speak for themselves.

Series F

Performance as at October 30, 2019

US small/mid cap equity

of 521 Funds

of 151 Funds

of 71 Funds

Share with your advisor

Don’t have an advisor?

Learn more about working with an advisor →Managing for success

Steve MacMillan – Portfolio Manager

Steve’s 18 years of experience, first as an analyst and now as a Portfolio Manager have helped form an investment strategy that looks to find opportunities while protecting the investors hard earned money through the ebb and flown of market conditions.

Ce site Web est fourni par Fidelity Investments Canada s.r.i. (Fidelity) à des fins éducatives uniquement et il est mis à votre disposition par votre responsable de tenue des livres et/ou votre promoteur de régime. Les produits de placement que vous achetez par l’intermédiaire de votre régime ne sont pas des Fonds Fidelity et ne vous sont pas offerts directement par Fidelity. Ils représentent une participation indirecte aux Fonds Fidelity au moyen de produits de placement qui investissent dans des Fonds Fidelity et qui sont offerts par votre responsable de tenue des livres et/ou votre promoteur de régime.

En utilisant notre site Web ou en ouvrant une session, vous consentez à l’utilisation de témoins, telle qu’elle est décrite dans notre politique de confidentialité.